What You Can Do To Support Struggling Businesses (and the easy loan that can make that happen)

Pre-Sale Vs No Pre-Sale: Which Loan Is Right For Your Client?

August 18, 2021It can be both difficult and saddening when a business approaches you for financial assistance, but the task of sourcing a lender to support them proves impossible. You might be finding currently that the majority of businesses are in the position of having limited or non-existent cash flow, and face the threat of closure unless they receive financial rehabilitation. Typically, these loans are impossible to process as traditional lenders won’t approve them. At Paramount, we’ve managed to establish how to sustain businesses during unpredictable circumstances where some others have not, providing stability and certainty where it is most needed.

The current COVID-19 pandemic has seen the broader community, businesses and individuals impacted in ways that will leave significant scars for many years to come. We have seen innumerable businesses, both small and large in size, forced to shut their doors temporarily earlier in 2020 - many of these have now needed to close permanently due to a total reduction in income within the current lockdown environment.

Many businesses have been forced to close their doors due to lockdowns

Last year, Paramount was in the privileged position to support a pub/restaurant in Victoria which was unable to operate due to the stringent lockdown restrictions. During this 3rd lockdown they decided to close the restaurant/pub, do a full renovation, get some working capital for cashflow and still keep all staff member’s employed during this lockdown period

To continue with the business rehabilitation, the business required a loan of $1.5 million cash-out option to continue supporting the needs of the business. The clients put up a residential asset valued at $6 million.Traditionally, cash-out options to pay for business expenses is considered a risky investment, and many traditional lenders will not commit to this type of loan.

Fortunately, Paramount excels at making difficult things easy. We are committed to serving the people and the businesses around us. Lockdowns are currently raging, especially in NSW, and businesses are suffering - but once restrictions are lifted, there is going to be a strong demand for financial rehabilitation. We want to be able to create space to help businesses achieve that, and as a result, have developed a product specifically for those requiring cash to rehabilitate.

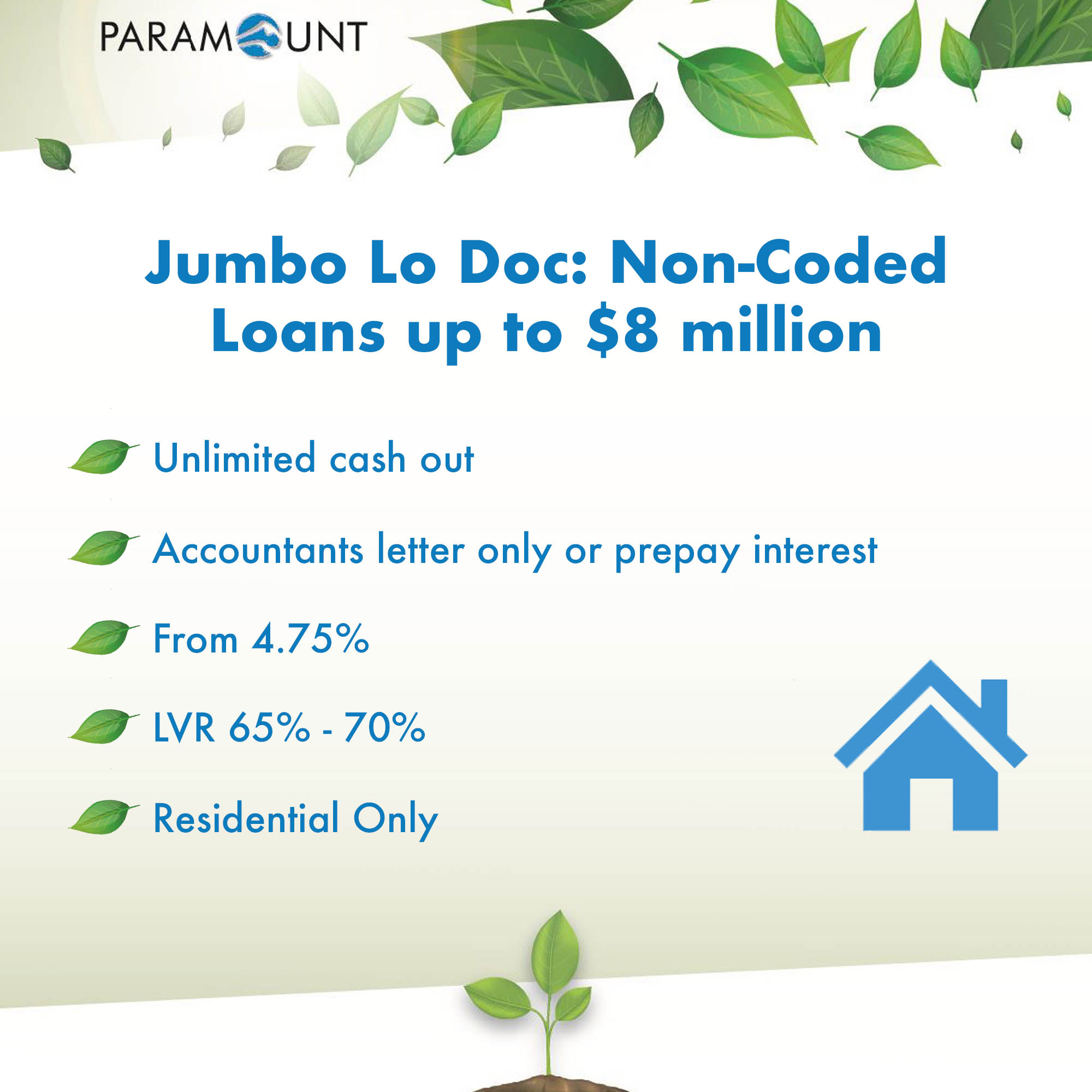

Our Jumbo Lo-Doc first loan can provide businesses with up to $8 million starting at an interest rate of 4.75%. With a LVR of 65 - 70% and the flexibility of monthly, capitalised or pre-paid interest, this loan is perfect for assisting businesses to bounce back from the devastating economic effects of COVID.

Using our Jumbo LoDoc loan, we were able to provide the Victorian pub with $2 million for a 12 month loan, enabling them to stay afloat and continue their normal operations. To reduce the stress of the business having to make regular monthly payments, we additionally pre-paid the interest at a rate of 4.75%.

The business was both satisfied and relieved at the result, subsequently being in a position to sustain and ensure its continued prosperity through our financial rehabilitation. Whilst this loan would have been challenging or potentially even impossible for other lenders, at Paramount, these loans are our speciality - it is what makes us different. They allow us to provide you with the tools to support your clients with ease, efficiency and flexibility, and subsequently ensuring an exemplary service.

To find a loan that will help your clients, give us a call today on 1300 799 399, or reach us via email at info@paramountmortgages.com.au.